Popularity Of Fiscal Policy Rises As New European Leadership Shows Up

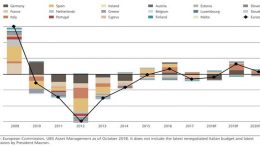

David Kohl (Julius Baer) | The European political leadership is in transition, with Ursula von der Leyen starting as President of the European Commission and Christine Lagarde as President of the European Central Bank and the Social Democrats in Germany voting for a new leadership. The common denominator of the most recent leadership changes in Europe is more openness towards an expansionary fiscal policy at the expense of austerity, which had been the mantra of the past ten years.