Should Germany Pay For Greece, Italy And others?

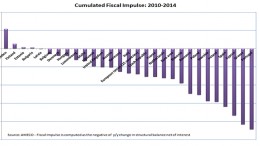

In a speech given on 11 June 2018 in the IFo Institute (Munich), former Greek Finance Minister Yanis Varoufakis noted the urgent need for a fiscal reform, which France and Germany see in a very different way, in order to save the Eurozone.