Is Germany’s growth losing momentum?

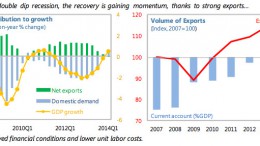

BERLIN | By Alberto Lozano | After Q1’s strong growth, numbers show that the German economy has slowed down during 2Q’s first two months, as Bundesbank reported this week. Both the industrial sector and the construction have fallen compared with the 1Q. However, it seems that Europe’s economic powerhouse will recover its strength in the coming months.