Euro Area Economic Watch Inflation update: it’s bad already, but it will probably get worse

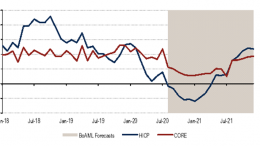

Rubén Segura-Cayuela (BoAML) | We still expect a top-up of the Pandemic Emergency Purchase Programme (PEPP) by another EUR500bn to stretch until end-2021- probably announced in December. That will be necessary to accommodate the economy. But it will not suffice to tackle long-term inflation dynamics and faltering expectations. More and longer policy support is needed, urgently.