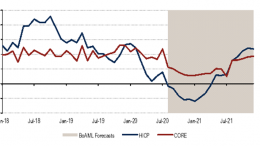

Ofelia Marín Lozano | In March, April and May this year we will see published inflation close to or above 2% year-on-year. But this can simply be explained by the rise in oil prices. Crude oil, which a year ago, at the height of its confinement, fell to levels of around 30 dollars per barrel, is now trading above 60 dollars per barrel, is now trading at over 60 dollars. In our opinion, although inflation could pick up notably in the second quarter of 2021, with year-on-year readings above the 2% that the US Federal Reserve and the ECB have set as a benchmark for the long term, the underlying inflationary risks remain well under control and support the maintenance of an accommodative monetary policy for a prolonged period of time. Simply put: core inflation only rises consistently if wages rise and, with higher unemployment, it is very difficult for that to happen.