Oil Investment Crash In Numbers: Capex Will Fall By 44% Over 2014-16

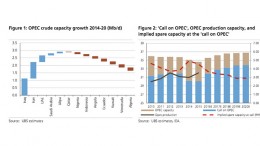

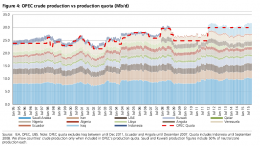

UBS | In recent notes (” Trouble down the line “, ” The outlook for OPEC production capacity “) we detailed the meaningful slow-down in activity we are seeing across the industry. This is being driven by a reassessment of portfolios, on grounds of affordability and in reaction to structural and cyclical deflationary dynamics. In this note we show the effect of this slowdown on investment levels. The results have been dramatic.