German factory output disappoints

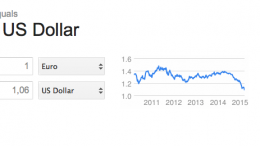

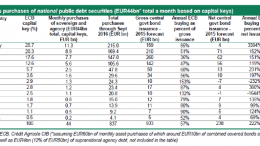

The Corner | April 8,2015 | German factory output disappoints as fears of slowdown in the U.S and China hit exporters in Europe’s largest economy despite the weakened state of the euro. Elsewhere, retail sales are expected to contract in the euro area having shown gains since the final months of 2014.