BARCLAYS | Repsol’s 2016-2020 strategy presentation set out the resilience of its integrated business model with a shift to a focus on value from the previous growth focused strategy. The company expects to be free cashflow breakeven after dividends at $50/bl Brent over the 2016-2020 period with the breakeven likely to be $60/bl in 2016/17 before falling to $45/bl in 2018- 2020.

The presentation had all the key elements we have come to expect from the oil sector of late: significant capex reductions, a much improved efficiency programme and a substantial divestment target to help streamline the asset base. And yet Repsol’s share price reacted negatively. To our mind this partly reflects the cont inuation of the dilutive scrip dividend programme – although this should not have been a surprise – but also perhaps less detail than we hoped for on how Repsol will be able to deliver the much needed improved upstream performance. Even so, we view the presentation as positive overall for Repsol and see it as providin g a base on which to rebuild investor confidence. This may be a work in progress for some time, hence our Equal Weight despite significant upside to our EUR22/sh price target.

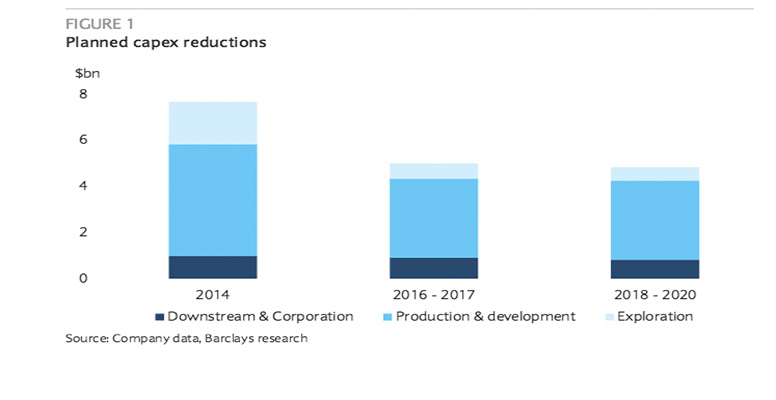

Cost reduction a clear focus: Some of the most eye-catching targets from the presentation included a 40% reduction in pro-forma upstream capex compared to 2014 levels and a new EUR1.5bn opex efficiency programme. This combined with an increased synergy target of $350m is respon sible for much of the planned improvement in breakeven over the plan period. The reductions are to be achieved through a combination of cost deflation, cultural ch anges, operational reliability and improved efficiency. The work on this plan has alre ady started with more than 50% of opex savings undergoing implementation and an announced reduction of 1500 employees.

Better than anticipated end to the year: Repsol also took the opportunity with its 3Q trading statement to provide full year net in come guidance of EUR1.6bn to EUR1.8bn. This is above our previous estimate of EUR1.5bn, and based on the updated outlook and a review of our own modelling assumptions we lift our EPS estimate for 2015 by 3% and we reduce our 2016-2019 forecasts by 3-5%.