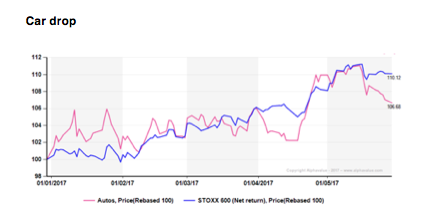

It looks as if sentiment has turned negative on the Autos sector over the last month. As reported by Carax-Alphavalue, “this has been as brutal as the previous month’s surge, confirming if needed how volatile investor perception can be on the sector”. The Autos sector is last month’s worse performer with a near 3% drop.

Car drop

The sector is a kaleidoscope of conflicting views with a real difficulty in balancing positives and negatives.

In the short run, the positives are that European plants are saturated meaning superior cash flows. In addition, European capex is slowly picking up, adding to EM demand which is good for trucks and construction equipment. According to the house’s analysts:

Easy money in the Eurozone and under-geared European consumers may consider updating their sooty diesels meaning that the near-term outlook on the demand side is good.

On the other side of the short term coin, Carax-Alphavalue points the US market is now tanking and residual values are eroding fast in a market that never was self- propelled but subprime credit driven.They explain that cyclical turn was all “too foreseeable” so should not be a real concern for the German players in the US.

More of a worry is the overall impression that European car manufacturers have lost the plot in China. The dash for electrical cars as organised by the central government has taken most by surprise while Sino competition is now pushing very credible locally designed products. Huge marginal profits on these German-designed wheels are a thing of the past.

The longer-term coin is one of a paradigm shift with a combination of dieselgate and better batteries fast forwarding the electrical car (see :“ A post combustion era” view, 03-05-2017) and a likely less-car-intensive new mobility business model. The ubiquitous personal car concept sounds past its prime, including possibly in emerging markets.

Elusive valuations

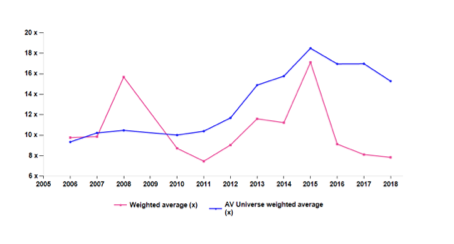

Valuing an industry where there is a near certainty of a business model change while it is already extremely competitive AND seeing a raft of new entrants (autonomous cars, Chinese new players, Indian domestic industry) is a challenge.

Sector PEs seem to have been experiencing a widening gap with the market since 2016.

Depressed Autos PEs (in pink) vs. AlphaValue average

Car manufacturers are trading at below 8x 2017 earnings (excluding PSA) while other sector players stand well above 11x and easily into 13- 15x suggesting more confidence in components/tyre suppliers and in heavy equipment than in European-designed cars. In the experts’ opinion:

Tesla is ridiculously expensive and the German car manufacturers ridiculously cheap but one may infer that the invisible hand is sending a powerful message about where the future lies.