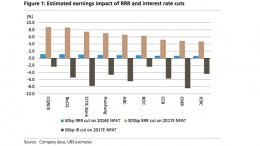

People’s Bank of China keeps lending rates unchanged

Link Securities | The People’s Bank of China (PBoC) announced early on Thursday morning that kept its lending rates unchanged after the central bank earlier in the week left its medium-term policy rate unchanged. The one-year prime lending rate (LPR), which is the medium-term lending facility used for corporate and household loans, remained unchanged at 3.55%; while the five-year rate, the benchmark for mortgages, was left unchanged at 4.2%, in…