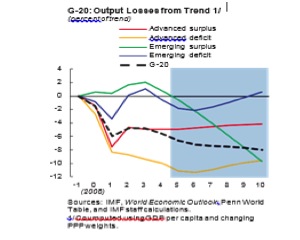

The G20 Finance Ministers’ gathering in Sidney calls for 2% boost in world output from 2014-18. The staggering $ 2.25 trillion push aims at fighting the entrenched growth gap identified by the IMF paper on Global Prospects and Policy Challenges widely endorsed in the meeting. The flaw lies in believing that future trends will mirror past performances. The crisis has severely undermined labour markets and investments, turning quite futile any discussion on potential growth.

We face a protracted recovery for years to come. While cautiously trimming public deficits and further easing monetary policy in the EU might help to defuse any unpalatable surprise, efforts should focus on implementing market driven reforms.

Lack of confidence has indeed severely dented demand all over the crisis. Yet, the current shortfall in production mainly stems from supply side snags. Blatant Inefficiencies are bogging down many advanced economies. Yet, emerging countries face a grimmer outlook. They have bet on cheap money for living beyond their means. As the US monetary stance stiffens up, they are bound for a bumpy ride. They would be well advised in following to the line IMF’s guidance. Credible macroeconomic policies and exchange rate flexibility are key in weathering current and foreseeable turbulences. Pressing the FED to refrain from its easy money stance, no matter the circumstances, seems an ill-judged endeavour. Instead, they should strive to perform their own homework the sooner the better.

Will the Sidney growth strategy fly? Germany and the ECB have voiced open scepticism on its merits. So long as growth continues to gain momentum, they is little chance surplus countries might revamp domestic demand in a co-ordinated effort for anchoring recovery. They will put into practice the well-seasoned “wait and see” strategy. Those bracing against imbalances will probably lure themselves in profiting from better prospects for shelving reform plans. Even a sluggish growth, so long as it goes on, will cool down any temptation to shift the current policy mix.

Don’t count on the ECB forcefully easing its monetary stance. Don’t count on the FED paying more attention to emerging countries’ worries than to keeping home stable conditions. Don’t count on Germany invigorating its domestic demand or on China dismantling its fancy exchange rate. For all the efforts undertaken by Australia in brokering a deal in the next November G20 Summit, the outcome will most likely amount to mere wishful thinking.

Be the first to comment on "G20 delivers growth on paper"