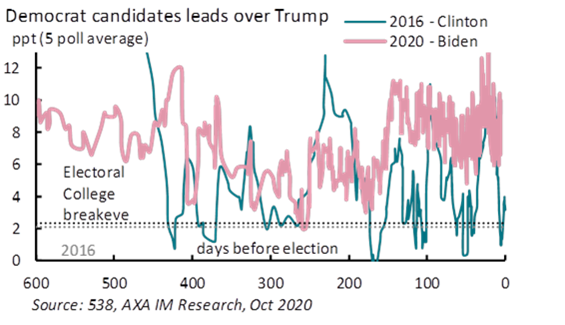

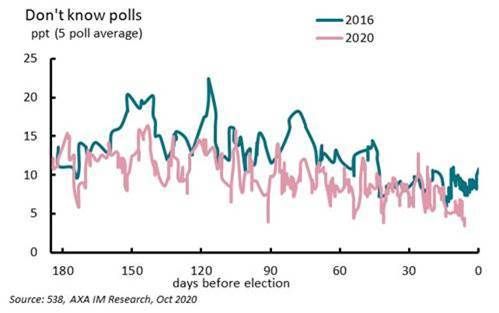

Gilles Moëc (AXA IM) | Unlike in 2016, there hasn’t been any last-minute decline in the lead the democratic opponent to Donald Trump enjoys in the polls (Hillary Clinton was hit in the last days by a return of the “private emails saga”), and since the number of votes already cast is as of Sunday above two third of the total ballots cast in 2016, it would take an absolute catastrophe for Joe Biden in the last two days of the campaign to alter the race (see Exhibit 1). Polls can be wrong, but we make the same point we have made before in Macrocast: the proportion of undecided voters in 2020 has been steadily falling and is now half of what it was in 2016 (see Exhibit 2). The Republican campaign is counting on a “shy Trump” effects, i.e. voters who are unwilling to state their preference for the incumbent when asked by pollsters. Logically, one would expect these “shy Trumpers” to declare themselves undecided instead of pretending to lean towards Biden. We note that the average Biden lead exceeds the average for “don’t knows”, which was not the case – by far – for Clinton in 2016, whose lead was thus significantly more fragile than what the headline number suggested.

Of course, the US presidential race is a cumbersome affair and a lead in national polls is not enough – after all Clinton won the popular vote in 2016. By and large, given the features of the electoral college, a democratic candidate needs at least a 2% margin in the popular vote to secure the presidency, but even this would not completely insure against a “freak distribution effect” with narrow defeats in too many states. Clinton lost because she failed to win in blue-collar, mid-western/Great Lakes states, although polls still gave her a small lead there just before the election. Still, pollsters have learned from their mistake. The issue then was an under-weighting of non-college educated white voters in the samples (reflecting a greater reluctance by this demographic to take part in polls). This has normally been corrected. Biden’s lead in the rust-belt should thus be more solid than Clinton’s. Nate Silver’s website 538 is currently giving the Democrat a 90% chance of winning. Their last forecast in 2016 had Clinton’s chance at only 71%.

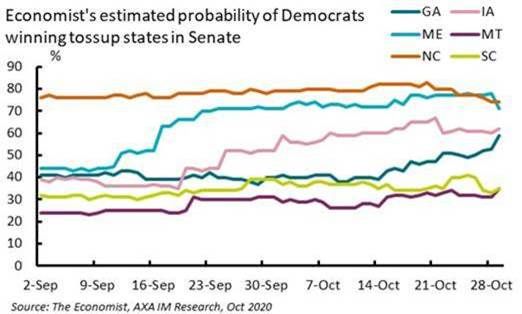

Markets have become increasingly focused on a “blue wave” with the Democrats winning the Senate on top of the White House. Currently the Democrats control 47 seats (counting two independents who caucus with them) against 53 for the Republicans. The Democrats are very likely to lose one of their incumbents, widely expected to be defeated in the Alabama seat which he won in a special election three years ago against a very controversial opponent. If Joe Biden becomes President, Vice-President Kamala Harris will give the Democrats a tie-breaking vote. They thus probably need to win four new seats. According to the polls, they are widely expected to win in Arizona and Colorado. Two more seats need to swing. Using the Economist forecasts, these could be found in Maine and North Carolina, with Iowa and Georgia also in play (see Exhibit 3).

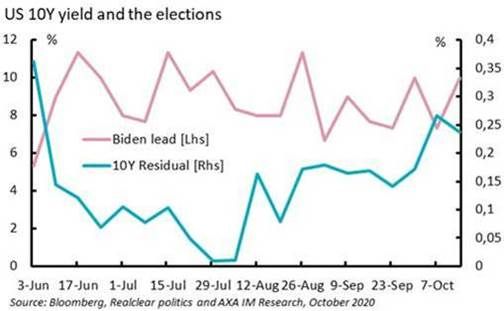

A blue wave would vindicate and probably prolong the rebound in US long term interest rates which has so far been resilient to the generally worse economic dataflow. We estimate where the US 10-year yield “should be” according to fundamentals by regressing it on the New York Fed’s Weekly Economic Indicator, the level of the Fed Funds rate and the Fed’s purchases of government securities. Using this simple model, the US long term rate is now roughly 20 basis points above its “fundamental” level. There has been no correlation between this residual and the gyrations in Biden’s lead in the polls since he won the primaries (see Exhibit 4) which has been relatively stable. We think the recent rebound in US long term rates reflects the market’s growing focus on the chances of a major fiscal push under Biden, rather than a change of opinion on whether he would win – this has been the most likely outcome since pandemic started.

Markets have become increasingly focused on a “blue wave” with the Democrats winning the Senate on top of the White House. Currently the Democrats control 47 seats (counting two independents who caucus with them) against 53 for the Republicans. The Democrats are very likely to lose one of their incumbents, widely expected to be defeated in the Alabama seat which he won in a special election three years ago against a very controversial opponent. If Joe Biden becomes President, Vice-President Kamala Harris will give the Democrats a tie-breaking vote. They thus probably need to win four new seats. According to the polls, they are widely expected to win in Arizona and Colorado. Two more seats need to swing. Using the Economist forecasts, these could be found in Maine and North Carolina, with Iowa and Georgia also in play (see Exhibit 3).

A blue wave would vindicate and probably prolong the rebound in US long term interest rates which has so far been resilient to the generally worse economic dataflow. We estimate where the US 10-year yield “should be” according to fundamentals by regressing it on the New York Fed’s Weekly Economic Indicator, the level of the Fed Funds rate and the Fed’s purchases of government securities. Using this simple model, the US long term rate is now roughly 20 basis points above its “fundamental” level. There has been no correlation between this residual and the gyrations in Biden’s lead in the polls since he won the primaries (see Exhibit 4) which has been relatively stable. We think the recent rebound in US long term rates reflects the market’s growing focus on the chances of a major fiscal push under Biden, rather than a change of opinion on whether he would win – this has been the most likely outcome since pandemic started.

Markets have become increasingly focused on a “blue wave” with the Democrats winning the Senate on top of the White House. Currently the Democrats control 47 seats (counting two independents who caucus with them) against 53 for the Republicans. The Democrats are very likely to lose one of their incumbents, widely expected to be defeated in the Alabama seat which he won in a special election three years ago against a very controversial opponent. If Joe Biden becomes President, Vice-President Kamala Harris will give the Democrats a tie-breaking vote. They thus probably need to win four new seats. According to the polls, they are widely expected to win in Arizona and Colorado. Two more seats need to swing. Using the Economist forecasts, these could be found in Maine and North Carolina, with Iowa and Georgia also in play (see Exhibit 3).

A blue wave would vindicate and probably prolong the rebound in US long term interest rates which has so far been resilient to the generally worse economic dataflow. We estimate where the US 10-year yield “should be” according to fundamentals by regressing it on the New York Fed’s Weekly Economic Indicator, the level of the Fed Funds rate and the Fed’s purchases of government securities. Using this simple model, the US long term rate is now roughly 20 basis points above its “fundamental” level. There has been no correlation between this residual and the gyrations in Biden’s lead in the polls since he won the primaries (see Exhibit 4) which has been relatively stable. We think the recent rebound in US long term rates reflects the market’s growing focus on the chances of a major fiscal push under Biden, rather than a change of opinion on whether he would win – this has been the most likely outcome since pandemic started.