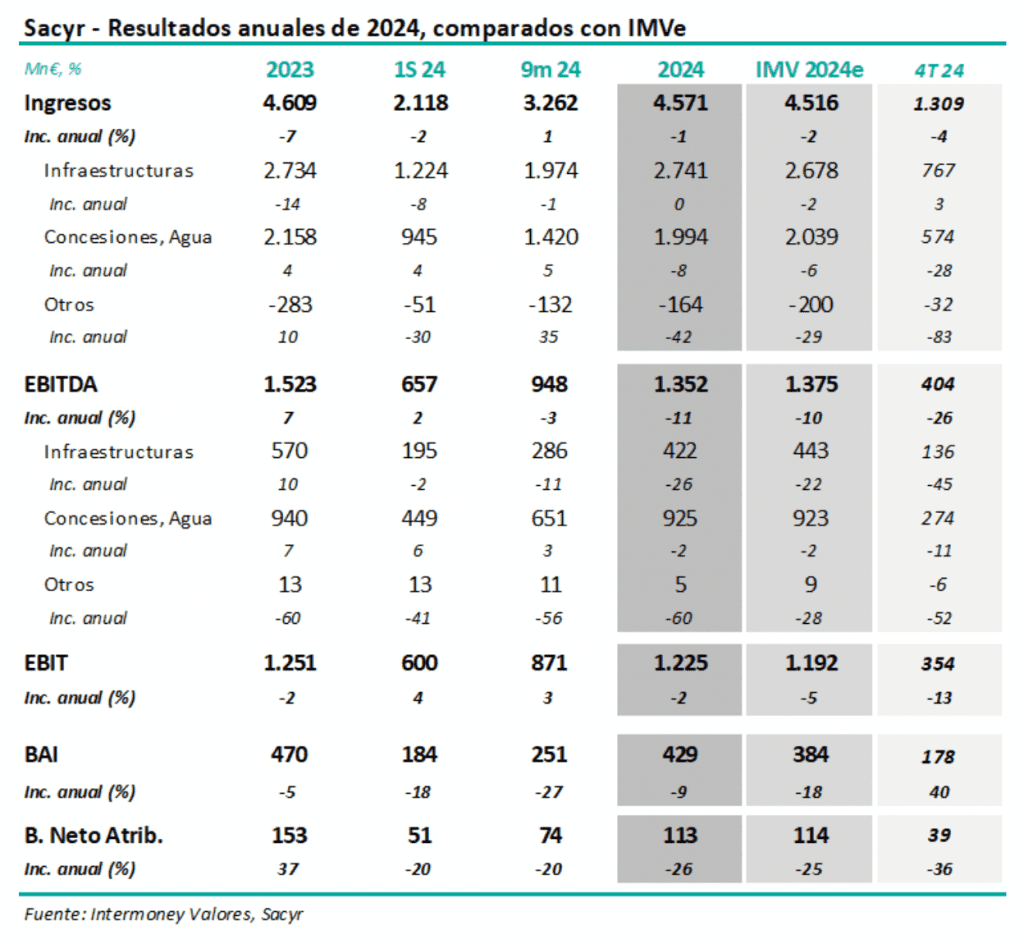

Intermoney | Sacyr (Buy, PO €4.4) announced its 2024 annual results yesterday after the market closed, and will hold a conference call today at 11am. The main figures, together with our estimates, are shown in the attached table. The Group has continued to moderate its operating results, mainly due to the accounting effect following the commissioning of new concessions, including the Pedemontana Veneta (PV) motorway, and a reduction in construction activity for its own projects, but with a significant increase in cash generation. As a result, accounting EBITDA has fallen by 11% to €1,352m (€1,375 million Intermoney estimate) despite growth in Concessions and Water (up 3%), but operating cash grew by 53% to €1,294 million, doubling from 2022; the EBITDA cash conversion rate thus stands at 96% compared to 56% in 2023. Amortisation and financial expenses limited the net result to €113m, down 23% compared to the figure for 2023 (€114m Intermoney estimate). We are not changing our forecasts for 25-27, which we have lowered by an average of -10% in the preview to take into account the accounting effect of the concessions already in service, which does not affect cash generation.

Revenues fell by 1% to December (2% Intermoney estimate), due to the decline in construction of own concessions. Sacyr reported revenue to December with a slight decrease of 1% to €4,571Mn, compared to 2% Intermoney estimate. The difference compared to Intermoney estimate was centred on the construction of own projects within the Concessions division, which was lower than expected. The stability in Infra (0%) was caused by the decline in activity for third parties, in line with the strategy of gradually reducing exposure to works other than its own concessions.

EBITDA fell by 11% to €1.352bn (€1.375bn Intermoney estimate), continuing the moderation of previous quarters. The EBITDA figure to December (down 11%) was slightly below the Intermoney estimate, with the two main businesses recording declines for accounting reasons characteristic of the concession business. Thus: Infrastructure, (down 26% compared to 22% Intermoney estimate) essentially dedicated to construction activities, and which includes concessions such as PV, ceased to benefit from the reduction in costs from 2023 onwards, but still benefited from an improvement in the mix, with margins thus increasing by 30 bp as of December, and EBITDA by 15% to €112 million (€104 million Intermoney estimate); the contribution of PV and Naples fell by 33% to €309m, after the entry into service of the former (€338m Intermoney estimate) which meant an EBITDA for the division as a whole of €422m (down 26%), compared to our forecast of €443m;

Concessions, including Water (down 2% compared to the 2% Intermoney estimate), in addition to the aforementioned negative accounting effect of the concessions put into service, benefited from the year-on-year improvement in traffic in Spain and a greater contribution from the concessions fully or partially put into service in Colombia and Chile last year. These two markets contributed €317m and €225m to EBITDA as of December, respectively, well above Spain (€131m).

Growth in cash generation from commissioned concession projects; cash conversion ratio at 96%. The annual results for 2024 showed a 53% growth in operating cash generation compared to 2023, reaching €1.294 billion, not too far from EBITDA (€1.352 billion). Therefore, the cash conversion ratio went from 56% in 23 to 96% last year. This trend is in line with expectations, as the new concessions begin to generate cash, as opposed to their simple contribution to book EBITDA during their construction period.

Net profit of €113 million in 2024 (down 26%). Below the EBITDA there were no big surprises, with financial expenses down slightly to €667 million (€693 million Intermoney estimate), contained by the relative year-on-year stability of the overall consolidated debt; more than 70% of the gross debt does not depend on the short-term evolution of interest rates. Positive items at EBIT level were offset by negative impacts from exchange rates. Sacyr reported a net profit to December of €113m (down 26%), compared to €114m Intermoney estimate.

Net debt increased by around €480 million since December 23, contained by the good performance of working capital. Net debt rose by around €480 million compared to December 2023 to €6,891 million (€7,050 million Intermoney estimate), mainly due to the past capital increase in May (€222 million), and to: 1) net capex of €836 million to 2024, while 2) working capital, which includes the positive cash flows from the new concessions, had an impact on operating CF of €786 million, compared to €421 million in 2023.