Intermoney | The company (Buy, PO €14.5) announced yesterday after the market closed an agreement with the investment fund CPP Investments whereby the latter will acquire 25% of the capital of the environmental services subsidiary for €1 billion. CPP had already held 25% of this business since 2023, although FCC reports that it will continue to hold the majority of the shareholding with 50.01%, compared to 49.99% held by the fund.

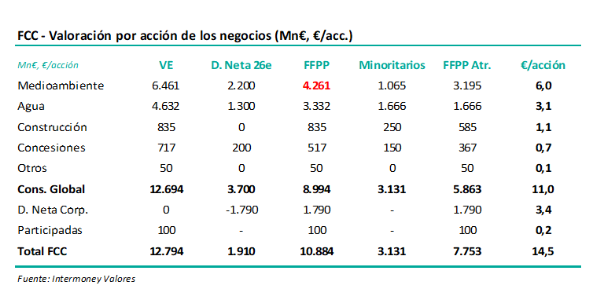

Assessment: This transaction is being carried out at a price very similar to CPP’s initial purchase of 25% in 2023, around €965 million. In our valuation of FCC, we value 100% of the environmental services business at around €4.3 billion, as shown in the table below. The transaction announced yesterday would therefore imply a slightly lower valuation (€4 billion), although we have set December 2026 as the discount date for cash flows, while the transaction has a reasonably closer date, so we do not see any significant differences between the two. The transaction implies an EV of the business of around €6.2 billion, or 7.2x the EBITDA we expect in 2026. Environment is by far the Group’s largest business, contributing approximately 53% of consolidated EBITDA (€862 million in 2026), especially following recent acquisitions in the United Kingdom, its most important market after Spain.

FCC is essentially replicating what it has already done with its Water division (Aqualia), where it also holds a 50% stake after selling the rest to the Australian fund IFM in 2018.