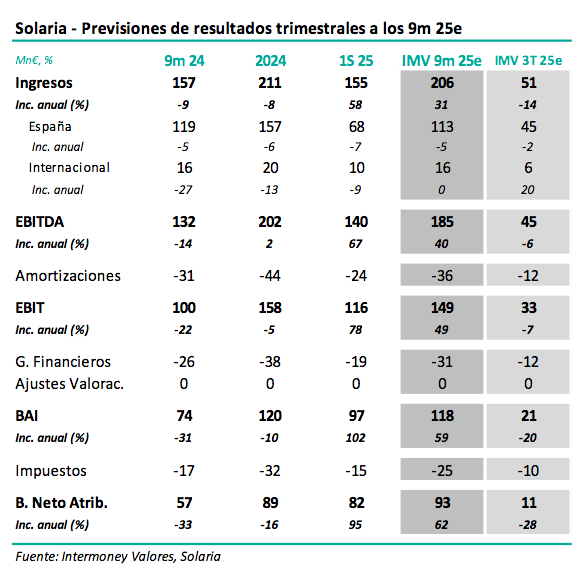

Intermoney | Solaria (Buy, PO €13) will announce its 9M25 results on 17 November, holding its AGM in London on the same day. The main figures from our estimates are shown in the table below and should reflect: 1) a year-on-year decline in production of 6%, as Solaria has the same installed capacity and following a mediocre first half in terms of weather; and 2) the impact of the Genería transaction during the first half, which contributed around €70 million to EBITDA in June. We therefore expect revenue and EBITDA growth of around 30% and 40%, respectively, compared to September 2024. Net profit would only be partially affected by increases in depreciation and financial expenses, rising 62% to €93 million (Intermoney estimate). We are not changing our EBITDA forecasts for 25-27, which we raised by 2% in our June note, including 9% for this year compared to our February figures, implying a CAGR in EBITDA of 15% in 24-27.

We confirm our Buy recommendation and our target price of €13.

Of course, the stock does not currently offer potential, but for the time being we prefer not to change our recommendation, since: 1) we are awaiting the company’s next CMD (17 November), where it could, for example, raise its guidance even for this year, giving the stock additional breathing room; and 2) given the volatility of the share, a sudden correction cannot be ruled out, which would generate potential for the stock, something we already saw in September/October. Since May, the stock has benefited from favourable news flow regarding the nascent data centre activity, despite its sporadic impact on results, something we expect to continue. Other positive factors include the new battery business and, in particular, a degree of certainty that the earnings guidance will be met. On the other hand, our valuation continues to be based on a CFD with a WACC of 8.75%.