China Private Banks Versus State Sector: Where Do Banks Lend?

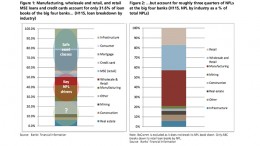

UBS | We reviewed the financial statements of 134 banks to understand loan exposure by industry as well as to try to estimate the size of private – sector lending versus state – sector lending.