British financial mutuals’ last laugh

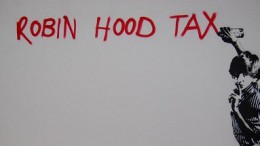

LONDON | The UK’s trade body of financial mutuals AFM is not happy. The organisation this week launched a frontal attack against taxpayer-aided listed banks and their directors’ bonuses. Who could blame them? After all, in the City race, mutual insurers, friendly societies and others have lost most ground: for instance, the sector’s insurance services today represent around 6% of the British market, while their share stood at over 50% just 15…