The US Dollar’s In The Spotlight

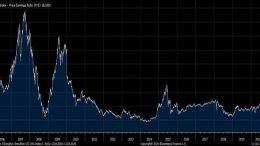

We enter the second half of the year with the cases of Covid-19 increasing uncontrollably on the American continent and in a very worrying way in the United States. The growing political uncertainty, accentuated by the trade conflict between US and China, puts the dollar in an unusual situation.Without falling into excessive pessimism, UBS AM Chief Strategist Evan Brown analyses in detail the current state of the currency and reveals his tactical positions given the current scenario.