How, For The USA, To Find A Balanced Momentum After Such A Shock?

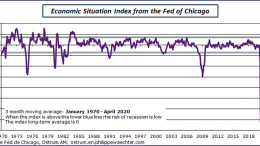

Philippe Waechter (Natixis AM) | The CFNAI index, calculated by the Chicago Fed, is the best measure of the economic situation as it is. It is a composite of 85 indicators published in one month. It includes industrial production, retail sales, employment and many more. It is published late compared to the surveys, but it perfectly reflects the state of the business cycle. It reads on average over 3 months and when it is greater than -0.7, the probability of recession is almost zero. Below this threshold, the risk of recession is high. See here for more details. In April, the index dropped more than 10 points to -16.74 from -4.97 in March. Its three-month average was -7.22 compared to -1.69 in March. The indicator is well below the threshold of -0.7. As the graph shows, The index is also well below the measures observed in 2008/2009. The shock is of a different kind and magnitude never before seen. This curve has the same pace as that of employment which in April contracted by 20.5 million.