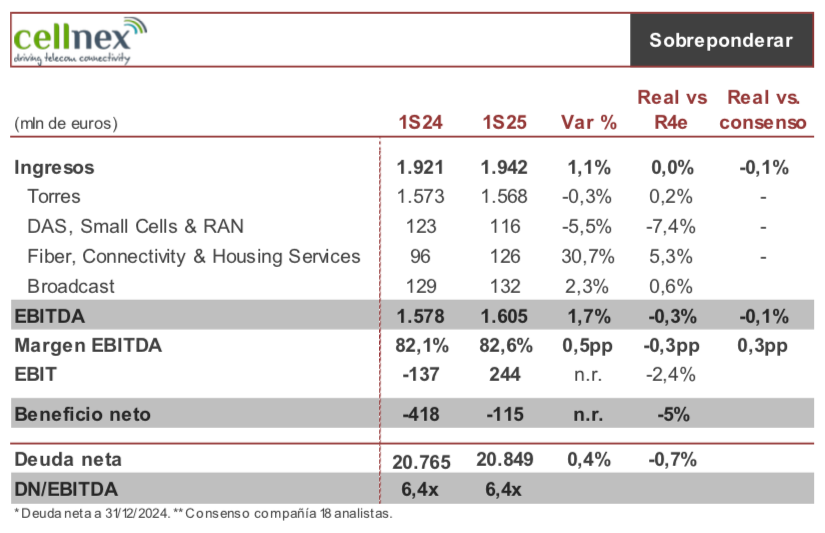

Renta 4 | Revenues grew in line with estimates, up 1.1% (6% pro forma) thanks to pro forma organic growth of 4% in points of presence (the remainder coming from placements and BTS, lifting pro forma tower business revenues by 5.2%), with a margin rising slightly thanks to the management of operating expenses and rents, allowing pro forma organic growth in EBITDA after rents of 8.1%, improving our outlook due to lower rents. EBIT is affected by the effects of the reorganisation of the structure in Spain and capital gains from the sale of assets in Ireland.

Cash generation significantly improves our expectations in RLFCF (up 6.5% compared to 1H24), as a result of lower rents, lower interest and taxes, as well as lower BTS and expansion capex compared to our expectations, bringing FCF to €19 million (compared to the Renta 4 estimated loss of 83 million). This performance means that net debt is slightly better than we expected.

No change in the 2025 and 2027 guidance following the adjustment made to the annual figures after the sale of the assets in Austria and Ireland.

The credit rating agency S&P has improved the outlook for the group from stable to positive, with the rating unchanged at BBB-, raising the leverage ratio threshold to 7x-7.75x from the previous 6x-7x.

Although the top line of the income statement is in line with the outlook, the improved cash flow and the upgrade by S&P mean that we do not rule out a positive reaction from the share price. We continue to see strong contract management, with an extension of the contract with Telefónica in Spain for the deployment of up to 3,000 new points of presence with Digi, and the renewal of the alliance in the Netherlands with Odido, which secures revenue for 15 years. We will see what comments they make on this, as well as the possibility of selling assets in Switzerland and other non-strategic assets. We reiterate our overweight rating, with a target price of €57.