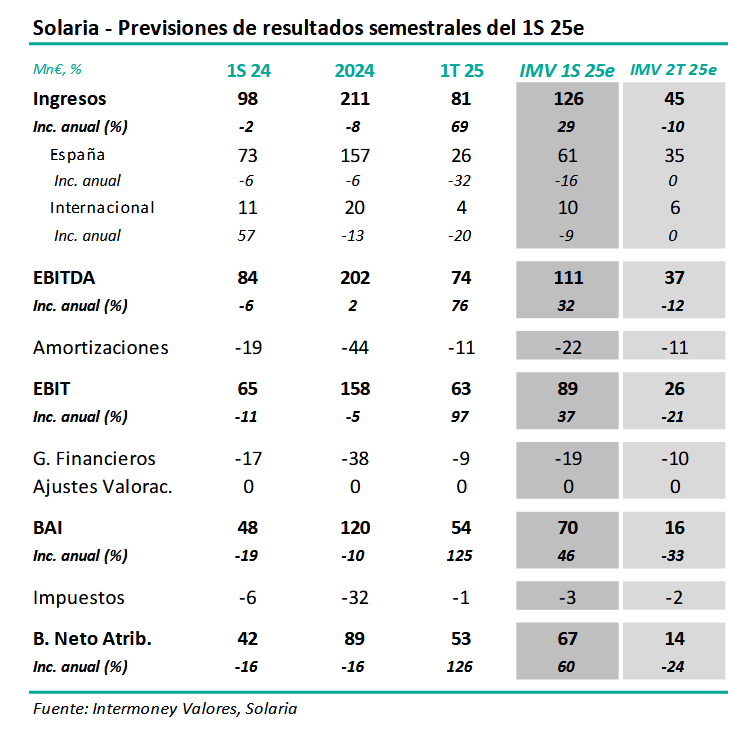

Intermoney | Solaria (Buy, PO €13) will announce its 1H25 half-year results on Tuesday 30 September, holding a conference call after the market closes. The main figures from our estimates are shown in the attached table and should reflect: 1) a year-on-year decline in production of 7%, as the company has the same installed capacity and following a mediocre first half in terms of weather; and 2) the impact of the Genería transaction during Q1, which contributed around €50 million to EBITDA. We therefore expect revenue and EBITDA growth of around 30% compared to June 2024. Net profit would only be partially affected by increases in depreciation and financial expenses, rising by 60% to €67 million (IMVe). We are not changing our forecasts for 25-27, which we raised by an average of 2% at EBITDA level in our June note, including 9% for this financial year compared to the figures we had in February, implying a CAGR in EBITDA of 15% in 24-27.

We confirm our Buy recommendation and our target price of €13 for December 26. Our valuation continues to be based on a DCF with a WACC of 8.75%. Since May, the stock has benefited from favourable news flow regarding the nascent data centre business, despite its sporadic impact on results, which we expect to continue. Other positive factors include the new battery business and, in particular, a degree of certainty regarding the achievement of earnings guidance. For all these reasons, and despite recognising the limited potential of the share at these levels, we prefer to maintain our Buy recommendation.