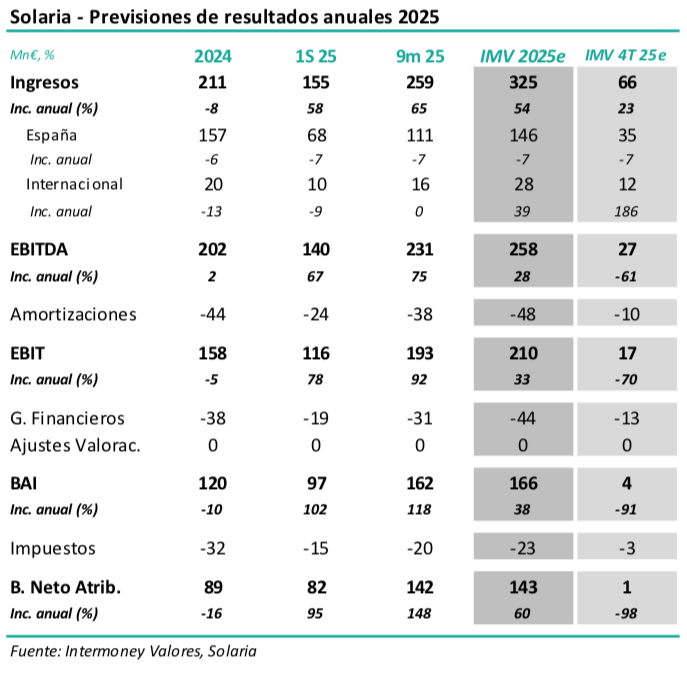

Intermoney | Results for December on 26 February; EBITDA up 28% to €258 million (Intermoney estimate); we confirm our estimates. Solaria (Buy, TP €16) will announce its 2025 annual results on Thursday, 26 February, holding a conference call at 6 p.m. The main figures in our estimates are shown in the attached table and should reflect:

1) a year-on-year decline in production of 4%, as the new capacity had a very limited impact last quarter; and 2) a halt in the impact of the Genería transaction during Q4, which contributed around €125 million to EBITDA in September. We therefore expect EBITDA growth of around 28% compared to December 2024 and slightly above guidance (€250 million).

Net income would be affected by the same circumstances, only partially affected by increases in depreciation and financial expenses, rising 60% to €143 million (Intermoney estimate). We are not changing our EBITDA forecasts for 25-27, which we raised slightly last November after the CMD, starting in 27, due to the increase in long-term installed capacity.

We confirm our Buy recommendation and target price of €16. We confirm our Buy recommendation and target price of €16, which we raised from €13 last November, dated December 26e. Our valuation continues to be based on a DCF with a WACC of 8.75%. Although the stock has exceeded our TP, we prefer to remain positive on it, waiting for the company to provide more clarity on its growth plans, which, according to Solaria, would imply long-term EBITDA generation (28) 42% above our forecasts, probably due to the contribution of the data centre business, which we do not currently include in our figures.