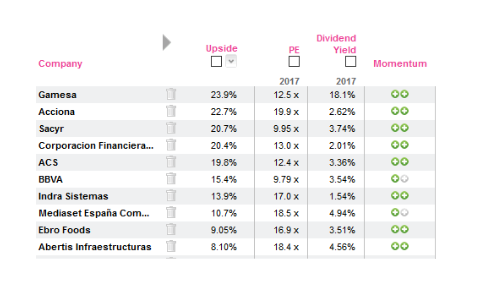

The Banco Popular (Option, Spain) collapse (06/06) has been swiftly dealt with, with Santander (Reduce, Spain) buying it for one euro, raising €7bn on its strong signature to reconstruct its core Tier1, becoming more Spanish in the process and preventing a bloody bailing-in of Popular’s subordinated holders. The unwritten bit of that decisive piece of action is that it protects further the respectability of signature Spain. Spain appears relatively cheap at 13.6x on a weighted P/E basis (see valuation table below) as it is dominated by banks and Telefonica (Add, Spain). The median provides a more realistic picture in the valuation (P/E at 17x) and EPS growth (17% this year). As a simplification Spanish P/Es are a meaningless middle between Inditex (Sell, Spain) (mkt cap.: €114bn) at 31x and Santander and Telefonica (combined market cap. at €135bn) at about 12.5x.

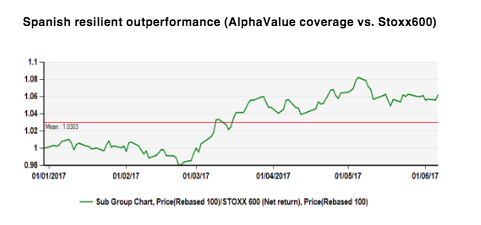

With markets having reached rich valuations and a degree of questioning possibly gaining ground, it is tempting to conclude that the money has been made on what has been regarded as a Spanish (and Portuguese) recovery in GDP growth terms. Beyond the remarkable and ever-more out of reach Inditex, there are stories carrying a Spanish flag that remain worth investigating even after the recent outperformance. Here is a list. Only Acciona (Buy, Spain) and Mediaset Espana (Add, Spain) are Spanish centric by the by.