MADRID | elconfidencial.com | The rescue operation of the Spanish banks is rather a foreign banks' bailout, the online daily El Confidencial reported Tuesday. Check the International Monetary Fund's recent study on Spanish banks and a graph shows up with an eloquent figure. The exposure of foreign banks to Spain is moving towards a colossal number: €1.2 trillion.

MADRID | elconfidencial.com | The rescue operation of the Spanish banks is rather a foreign banks' bailout, the online daily El Confidencial reported Tuesday. Check the International Monetary Fund's recent study on Spanish banks and a graph shows up with an eloquent figure. The exposure of foreign banks to Spain is moving towards a colossal number: €1.2 trillion.

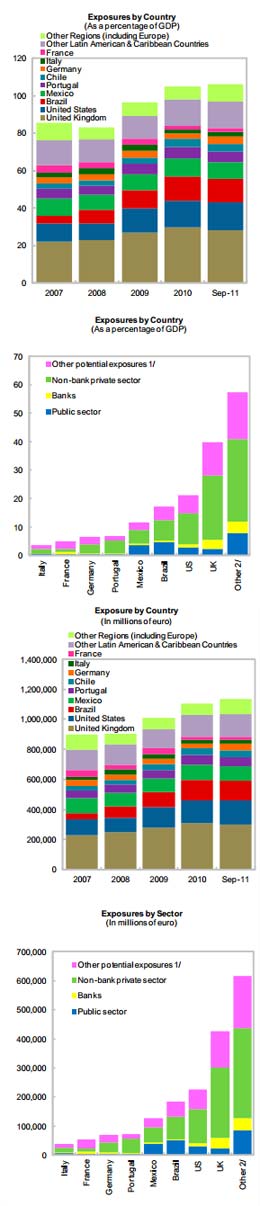

What is surprising is not just the sheer volume of it but also its evolution, which has not stopped growing in recent years. The foreign banks' Spanish exposure has risen by 20% since 2007, the first year of the crisis.

US and British banking sectors are by far the most exposed t

o Spain. In the first case, with some €300 billion, and in the second with about €200 billion, representing just over 40% of total exposure.

The figures are higher than those recorded by the Bank for International Settlements in March last year, which estimated that exposure to Spain by US banks amounted to €187.5 billion, while the British figure was of €152.4 billion. To get an idea of what these numbers represent, one must take into account that this is four times the exposure to Greece from international banks.

That BIS calculations stated that of the total exposure, more than a quarter was for loans to banks. Specifically, €269.7 billion.

According to the BIS paper, the German banking's Spanish exposure was €85,8 billion, and the French figure was €55.8 billion, being both the most exposed to the problems of Spanish banks.

Brazil, Mexico and Portugal also sum €250 billion in Spanish exposure, the FMI noted.