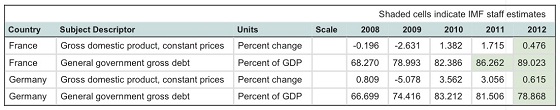

By Luis Arroyo, in Madrid | The European common currency has become poisonous for almost everyone else but Germany. Check below a chart coming from the International Monetary Fund, which shows that not even other core euro economies (that is France) have been able to profit as much as Germany. It also renders perfectly understandable why Nicolas Sarkozy lost the general elections and why he did so amid angry voters.

While Germany reaches better growth rates and its debt per GDP percentage improves, Europe's supposedly second soundest pillar experiences limited growth and sees its debt per GDP increasing much more. France is in the 'I might need a

bailout' queue, too. From a reasonable 68 percent of debt per GDP four years ago, it will have this year an 89 percent, and only if optimistic expectations about its GDP are met. Where will the capital come for the foreseeable bailouts? Not from France, which cannot abide by any debt and deficit protocols. France does not have a spare penny.

Germany has enjoyed a luxurious growth rate of 3.5 percent and 3 percent during the last two years, and has cut down its sovereign debt, and now faces the risk of suffering the waves of recession rising elsewhere in the euro area. So what it's becoming harder and harder to explain is why the European Central Bank does nothing, why Germany does nothing while its own economy flattens. It expels real danger over the upcoming euro summits, in which the current route to treat the euro troubles must be changed.

Where did you get the bizarre idea that Germany has to pay for the sins of other European countries?