But as yesterday we made another step towards Grexit, it struck me how close the two sides are on the most controversial issue, namely primary surplus. Greece conceded to the creditors’ demand of a 1% surplus in 2015, and there still is a difference on the target for 2016 of about 0.5% (around 900 millions). Just look at how often most countries, not just Greece, respected their targets in the past and you’ll understand how this does not look like a difference impossible to bridge.

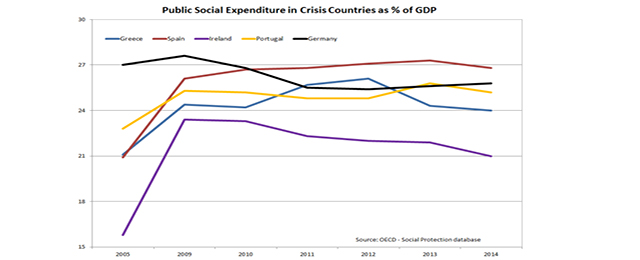

The other issue is reforms. Creditors argue that Greece cannot be trusted in its commitment to reform. After all, it cheated so often in the past… In particular, creditors highlight one of Syriza’s red lines, the refusal to touch pension reforms, to demonstrate that the country is structurally incapable of reform. And here is the proof, the percentage of GDP that crisis countries spent in welfare [see graph above].

I took into account total social spending which bundles together pensions, expenditure for supporting families, labour market policies, and so on and so forth. All those types of expenditure that, according to the Berlin View, choke the animal spirits of the economy and kill productivity.

Well, Greece does not do much worse than its fellow crisis economies, but it is true that it is hard to detect a downward trend. The effort at reform was not very strong and certainly not adapted to an economy undergoing such a terrible crisis. The very fact that after four years of an adjustment program the country spends 24% of its GDP on social protection is proof that it cannot be trusted. This is just further evidence of the fact that the Greeks made fun of their fellow Europeans and they want us to pay for their pensions.

Hold on. Did I just say “terrible crisis”? What was that story of ratios, denominators and numerators? The ratio is today at the same level as 2009. But what about actual expenditure? There is a very simple way to check this. Multiply each of the lines above for the value of GDP. Here is what you get (normalized at 2009=100, as country sizes are too different)…

*Continue reading at Francesco Saraceno’s blog. You can follow him on Twitter here.

Be the first to comment on "Greece: Reform or perish"