At its Governing Council meeting today, the European Central Bank is expected to confirm the termination of the asset purchase programme by the end of December 2018. The expiry date had so far been subject to incoming data and the medium-term inflation outlook. While incoming data in the past weeks has been rather disappointing, economists at Julius Baer see the solid credit activity as a valid reason to stop asset purchases. Furthermore, in view of softer gross domestic product and leading indicator readings, they think that investors should remain calm about changes in the ECB’s interest-rate policy. The ECB will also release technical details of its reinvestment policy.

A full reinvestment for an extended period of the EUR 2.6 trillion worth of assets accumulated under the programme reflects the commitment of the ECB to maintain generous liquidity conditions.

The experts at the firm do not expect any clear guidance regarding the ECB’s interest-rate policy, as the weakening economic growth outlook helps the ECB to justify maintaining its deposit rate at -0.4% and the main refinancing rate at 0% at least through the summer of 2019, as indicated in the previous statement. Even rate hikes beyond this date are unlikely given the softer growth outlook.

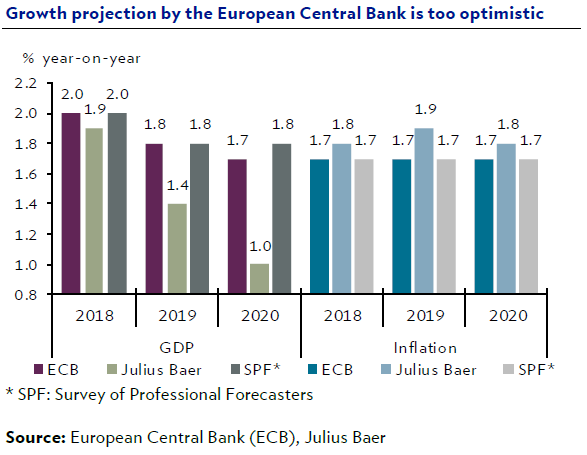

In addition to the monetary policy, analysts expect the ECB to present a downward revision of the growth outlook in the new staff macroeconomic projections. In particular, the expected growth rate of 1.8% for 2019 appears quite optimistic.

We expect a downward revision to 1.6%-1.5%, slightly above our more cautious projection of 1.4%. Inflation could be revised up for this year and the next as well, although the most recent collapse in oil prices argues against a significant increase of the 2019 projection of 1.7%. The lower growth projection will serve as the main argument to stress that monetary policy beyond the end of asset purchases will remain loose and ensure an ample degree of monetary accommodation.