CaixaBank Research | Historically, and in general, increases (or falls) in consumption go hand in hand with bigger increases (or falls) in consumer loans. This relationship is particularly close in the case of durable goods, which is the category that receives the most financing since it often involves larger expenditures.

Unlike in past crises such as the Great Recession, this time the rebound in consumption will be higher: we expect nominal consumption growth in 2021 and 2022 to be higher than the gradual recovery seen in the previous crisis. This higher recovery rate is explained by the fact that much of the savings generated in 2020 were forced and are expected to be undone relatively quickly, and also because the economic support measures have mitigated the impact of the crisis on households. This more rapid recovery in consumption will also drive greater growth in consumer lending, although the extent of the rebound will depend on how the excess savings have been distributed.

Evolution of consumer borrowing: a disaggregated analysis

During 2020, household debt for consumption purposes fell by an annual rate of 2.6% due to the collapse in consumption (which fell by 12% in 2020) as a result of the restrictions on mobility. These exceptional circumstances also affected new consumer lending, which fell by an annual rate of 26.6%. This contraction of debt was partially eased by the legislative and sectoral moratoria provided to the most vulnerable households.

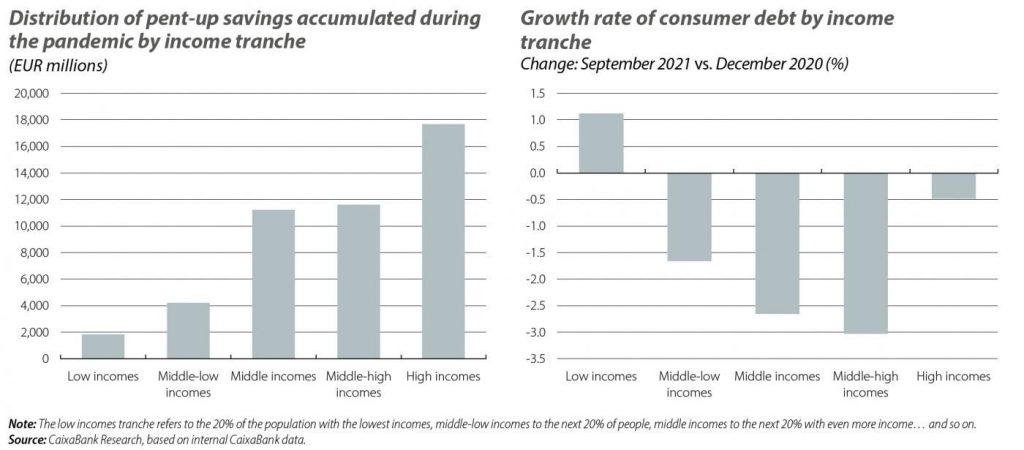

During 2021, and following the lifting of the restrictions on mobility, consumption has recovered and, with it, new lending. In particular, between January and September, cumulative new lending has grown by 7.6 % year-on-year. This has brought the contraction in household consumer debt down to a more moderate –0.4% in the current year to date. When we use internal and anonymous CaixaBank data to study how this debt has evolved during 2021 by income level, we see that it has increased for the lowest-income group, has fallen significantly for middle-incomes and has fallen more gently among high incomes.

With regard to middle incomes, the result is consistent with a deleveraging process, since this was the group that had amassed the highest volume of debt prior to the pandemic (58% of consumer debt was concentrated in this group). In addition, this collective saved a lot during 2020, accounting for around 60% of the aggregate excess savings in 2020 according to estimates based on internal data. Our results suggest that these middle-income households have taken advantage of their excess savings not only to consume in large quantities,3 but also to deleverage. In other words, there has been some pushback for this group. In contrast, lower-income households had modest excess savings in 2020 and they are also the ones who are consuming the most vigorously in 2021 compared to the pre-pandemic period. It is therefore logical that they are financing this high level of consumption, which would explain why their debt has risen since the height of the pandemic. Finally, those with high incomes, who accumulated 38% of the excess savings in 2020, have a low burden of consumer debt relative to their income, and this would explain why they have not used these savings to reduce their debt to the same degree as middle-income households.