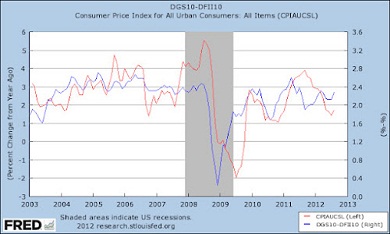

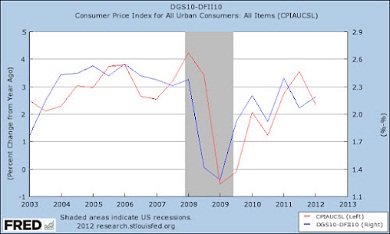

The announcement of a US Federal Reserve’s asset increase plan has obviously impacted the debt markets, with inflation expectations jumping up, as readers can see following the blue line of the graph above.

These expectations are the result of taking nominal interest rate at 10 years from the interest rate of 10-year sovereign bonds. It is considered to be a trustworthy indicator because both ratios trade separately and it tells us what changes investors forecast.

One may wonder about the quality of the predictions that these expectations signal, that is, if inflation after a certain amount of time behaves in the manner that was thought. That’s why we add month-on-month inflation. It turns out that the indicator rightly points out inflation movements qualitatively (they’ll appear in the consumer price index) when we face wide variations, in cases of crisis and deflation, even though quantitatively isn’t precise. It is finer tuned in long periods of time, semi-annually, as in this graph.

Nevertheless, in the current environment, further inflation will come accompanied by higher economic activity, which is what the Fed seeks to achieve. The US central bank has switched from trying to ensure stability to increasing job creation.

The lesson? Well, that is what happens to eggs when you make an omelette.

Be the first to comment on "Bernanke despises inflation horror tales"