The economic recovery has been solid in the Eurozone, while also diversified. Monetary policy has contributed to this recovery, when bank lending has accelerated and converged between countries. The recovery should translate into a sustainable rebound in inflation…

Who said all this? ECB board member Praet.

And where did he say it? During a panel discussion at the G20 conference organised by the Institute of International Finance

And when might interest rates rise in Europe? Following the path set by the Fed yesterday, which hiked rates 0.25 basis points to 0.75/1%.

After calmly reading through Praet’s intervention, it doesn’t look as if the ECB will raise rates quickly. But what is clear is that the conditions could present themselves which favour a change in bias in monetary policy. And sooner rather than later.

For the moment, let’s see what lies beneath the Fed’s decision yesterday:

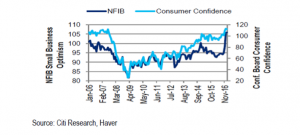

- Consistently positive economic data

- A clearly unequal balance of risks: risks derived from a monetary policy which is too lax; risks derived from an excess of economic optimism; risks derived from an expected expansive fiscal policy.

- Taking the opportunity to continue with the normalisation of rates.

In the end, it’s about reducing the expansive nature of monetary policy. It’s not about (yesterday there was emphasis put on balancing risks) seeking out a restrictive monetary policy: it’s just simply about making it less expansive. The relatively neutral tone of Fed chair Yellen’s speech later made it clear that there are no major changes in the bias from previous meetings. But now interest rates are a quarter of a percentage point higher.

The dollar’s rate curve discounts a 10 basis points increase in June, 25 basis points in September and 37 basis points in December. And this is after the Fed maintained its growth forecast for this year at 2.1%, raised it to this level in 2019 and also increased the core inflation forecast for this year by one tenth of a percentage point to 1.9%. But Yellen also stressed there is a symmetrical target for inflation, which was interepreted as their being less of an inflation risk. Despite the fact it raised its forecast.

No, there was no mention of reducing the Fed’s balance.

So where are we now? Analysts at Citi say that the Fed’s decision yesterday “leaves the door open for taking a risk in the markets.” In my view, prioritising financial stability in the short-term, with extraordinary monetary measures, only brings with it more risks to this stability in the medium and long-term. That said, the fact is that while we are talking about them, the official interest rates are gradually rising in the US. Meanwhile, in Europe, it’s the markets which are increasing their interest rates.