EPS estimates for global banks in 2015 cut by 3.4% over past year

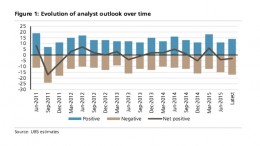

Based on our latest in-house banking survey, sentiment towards the banking sector has deteriorated further over the past quarter. The decline in expectations on the banking outlook reflected rising global growth concerns, uncertainty over Fed funds rates, as well as volatility in commodity prices and currencies.