Italian Debt As An Alternative To Spanish Debt?

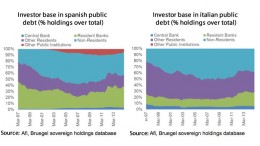

The current uncertain political panorama in Spain after the December 20 elections has not been reflected in any significant way in sovereign debt spreads. The yield on the 10-year bond compared with the German bund is around 130 bp, no more than 10-15 bp above the pre-elections level. One alternative to reduce (or diversify) exposure to Spain’s public debt may be take positions in Italian debt.