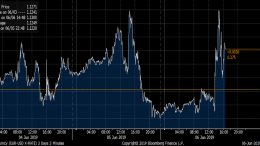

The ECB “does not give up” to low inflation

The European Central Bank will have to relax its monetary policy again, possibly through further reductions in interest rates or the purchase of assets, if inflation in the eurozone does not meet its target. Chairman Mario Draghi underlined that the ECB’s the limits are flexible because the its legal powers allow it to deploy tools that are both “necessary and proportionate”.