Falling oil price: 4 wins for Germany

ZURICH | UBS analysts | We see 4 wins for Germany in a backdrop of falling oil prices

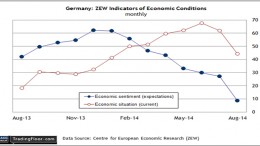

1) German equity market is not exposed to Oil & Gas earnings. 2) While our Oil & Gas analysts expect energy capex to fall by 10% (which could hurt a cyclical Germany), the overall fall to European capex is < 3%. Plus capex is already at a 23 year low – can it get much worse? 3) Our economists think lower oil triggers sovereign-based QE given their view it pushes CPI even lower than Tuesday’s 0.3%.