Crunchtime For Fed Chair Jerome Powell?

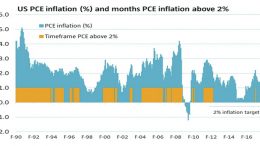

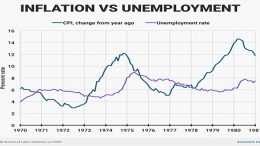

Benjamin Cole | Fed Chair Jerome Powell has stated the Fed’s 2% target is symmetric, which may be code words for “inflation a little above 2% is tolerable.” The US central bank may find fighting inflation resembles heart surgery with a chainsaw.