Credit And Liquidity In The Eurozone

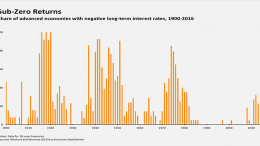

J. L. M.Campuzano (Spanish Banking Association) | During one of the conferences at last week’s Jackson Hole meeting, ECB council member Benoit Coeure analysed the extreme monetary measures taken by the ECB (in reality by all the main central banks) during the crisis. His opinion was that the neutral interest rate equilibrium is now very low (the product of a combination of low potential growth and low inflation expectations) which explains the remainder of the exceptional measures implemented.