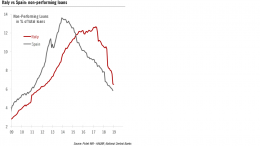

Spanish banks NPLs fall to 2010 lows

Bankinter | The rate of Spanish banks´non-performing loans fell in March to 5.73% (-1.07 pp m/m), the lowest level since 2010. It is good news for the sector, which confirms the improvement in the credit quality indices observed in recent years. Bad debt is therefore distancing itself from the highs of 2013 when it reached 13.61% in the middle of the economic crisis in various Eurozone countries.