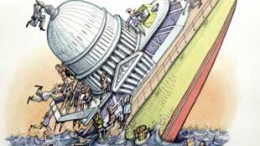

An impending euro catastrophe? Fear the ones you hear nothing about

Another week left behind us and another wave of alarms about euro zone banks being de facto rescued by the European Central Bank’s long-term liquidity operations or expecting European Financial Stability Fund capital injections. Sí, Spain and its financial sector were back in the headlines, somehow accompanied by Portugal and Italy in a variety of doom-and-gloom combinations, with what some in Madrid see as self-fulfilling forecasts. At The Corner we say shooting the…