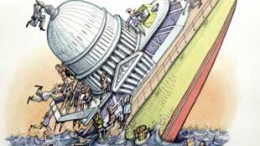

The US debt is a time bomb

By Luis Arroyo, in Madrid | Here is a consistent interpretation on the Marginal Revolution blog, by Tyler Cowen of Bernanke in 2008. It is consistent with economic and political circumstances. “How is that for self-recommending? Here in a short paragraph is my current take on where Ben Bernanke would differ from Scott. As the shadow banking system was imploding in 2008, due to a downward revaluation of collateral, nominal gdp stabilization…