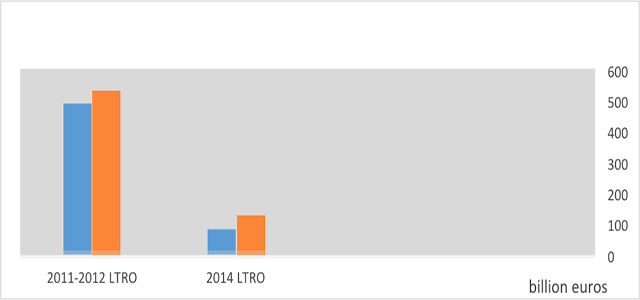

Other quantitative easing measures have been worse. The ABS purchase triggered by the ECB has drawn a meagre €0.6 billion while the covered bonds facility has levied just €20 billion. Thus, any hope of increasing the balance sheet by €1 trillion seems utterly out of reach. Even more so, considering repayments over the next few months from the previous LTRO launched back in 2011-2012 will double the liquidity injected up to now.

Unless the ECB implements a forceful debt-buying process in the coming year, its balance sheet is likely to shrink. That would be a most unpalatable outcome, depressing the prospects for an early recovery still further. Yet the Greek debt crisis may delay any move in that direction. The ECB can hardly take the risk of buying Hellenic bonds that are bound to fall into default. Neither can it refrain from buying them, as such a rebuke would trigger widespread speculation, adding extra weight to arguments from extremist Greek parties eager to wipe out any outstanding public liability. The ECB might wait and see until this potential unrest is over.

Failure to implement the low-key QE strategy seems closely linked to the banking system’s stubborn reluctance to bloat their balance sheets with idle resources as firms and households refuse to raise their indebtedness levels. Cheap money doesn’t increase the appetite for new loans. It only invites struggling debtors to refinance their liabilities on better terms.

Higher expectations for a fully-fledged quantitative easing programme serves only to increase asset prices, all the while lowering interest rates to fresh levels. That is a scenario which hardly helps to fence off the current state of deflationary malaise. It also underlines the sheer lack of confidence the market has for future growth.

The ECB’s monetary policy seems to be running out of steam, with the odds stacked formidably against finding any way out of the current crisis. Only the Federal Reserve can save the day by raising its rates. Janet Yellen holds the key for fostering depreciation in the euro, a measure that would expand European external demand and relieve the confidence gap hitting our economies. For all the efforts undertaken by Draghi, only a decisive switch in US monetary policy can bring any hope of reversing the current mood of sluggish, crippling economies.

Be the first to comment on "The ECB easing fails to fly"