Lloyds and RBS paid this week the lowest prices since January 2011 in exchange of market credit, unlike most of their counter-parties in the continent. A thorny question here–one more–to have voiced during the last European Union summit: who is really concerned about the euro’s spreading, chronical crisis and who would only be paying lip service to good wishes for a prompt recovery? After all, for some this seems a conveniently currency-localised turbulence.

But bank equity investors should feel suspicious of EU entities outside the euro zone, too. JP Morgan has issued a note on British banks revealing exposures to increasing dependence on external support for funding costs, focus on net profits, and regulatory pressures for debt sale when unanticipated charges reduce absolute capital.

Lloyds and RBS would be first in line to face the blow, analysts said.

“We believe that the market is yet to fully incorporate the implications of the recent shift in the UK regulatory approach,” the Europe equity research department suggested. One such change could have made the British banking industry more inscrutable instead of more open to investor surveillance.

The UK financial watchdogs put now more emphasis in absolute capital generation than in the compliance with Basel 3’s 10 percent core tier 1 ratio. That frees the entities’ liquidity buffer and lets them open their lending activity again–credit availability for mortgages has improved, JP Morgan pointed out–, yet “it makes more difficult for the market to track the progress on capital, as the benchmark is not publicly available and varies bank by bank.”

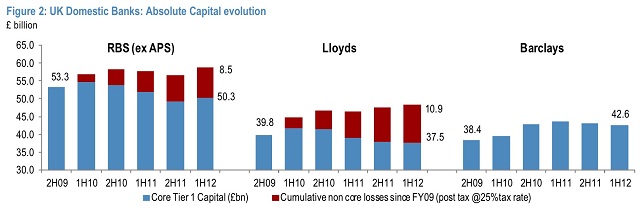

In fact, since 2009, RBS’ absolute capital has shrunk by -3 billion pound and by -2.3 billion pound in Lloyds’ case, in spite of core profits before tax being 17 billion pound and 15.7 billion pound, respectively.

Then, there is the self-inflicted wound of payment protection insurance policies having been mis-sold to retail customers.

Over 34 billion pound of those products were bought during the last decade, mostly unknowingly or after misleading, insufficient information. The Financial Conduct Authority estimates that 95 percent of all policies are liable of payouts by the banks, whose provisioning level is 10 billion pound.

Still, the British economic backdrop has shown some resilience. “We believe that core UK earnings could benefit […] the UK banks’ margins and loan growth measures,” JP Morgan admitted. It added: “It is not enough to reverse the drop in asset value in the medium term. Also, increased lending now builds up the long term risk in our view, which the banks may not be fully prepared for if new lending is not backed by capital.”

Be the first to comment on "JP Morgan airs concerns over side-effects of recent regulation for UK banks"