UBS | The oil price crash and ongoing volatility have created uncertainty and financial stress across the sector. An industry in ‘survival mode’ has manifested in major capex cuts and seen M&A activity collapse to 14 year lows. But austerity measures are seeing cost bases reset – cash neutrality for European Integrateds falls to $50 -60/bbl by 2017E from $110/bbl in 2014, a level that should see ‘books balanced’. Attention must shift to how to adapt to a post -OPEC world, where price-elastic U.S tight oil will play a key role and traditional hunting grounds (higher cost offshore, LNG, oil sands, etc.) are under threat.

M&A will play an inevitable role in industry restructuring

Initial industry response has focussed on reducing cost by combination of decreased activity and increased productivity. Results have been impressive. The next phase, though, must involve more fundamental strategic restructuring around cost advantaged resources. M&A will play a key role. Prudent management teams will likely assume U.S tight oil sets marginal prices (n.b. this is not UBSe base case). This speaks to deferral of long-life unconventionals and challenging resource themes (e.g. Arctic; oil sands, LNG). M&A will focus on projects with low capital intensity and bulletproof positions on the cost curve (onshore, sha llow water, top tier deep -water projects). U.S tight oil plays are set to remain well bid, the uniquely flexible and short investment cycle clearly attractive. Internationally, Brazilian pre-salt, East African onshore rift-plays (Lake Albert; Lokichar Basin) and quality OECD assets such as Johan Sverdrup in Norway stand out.

Many players left between a rock and hard place: buy expensive or shrink?

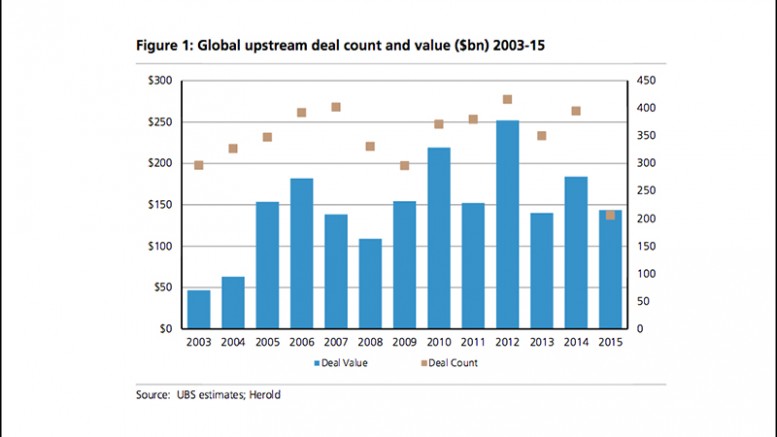

Whilst there is no shortage of assets on the market ($275bn), inventory is of variable quality. The implied long term oil price in deals last year remained steady at $79/bbl and the rate of unsolicited (20% of total) and rejected (18%) offers was at the highest level in over 20 years. This suggests significant price competition for quality assets and a challenging landscape in which to create shareholder value through M&A. Within the European Integrateds our top picks have exploration led upstream portfolios of quality and depth (Eni) that negate the need to chase new opportunity, or have already made decisive strategic moves (Shell). Within the E&P’s we see Tullow (East Africa) and Cairn (Senegal) as potential beneficiaries through asset disposal programmes.