Some quotes from the interview show quite clearly that Fisher was sending a strong “message”:

- The slowdown in demand growth overseas will have very little effect on the US economy.

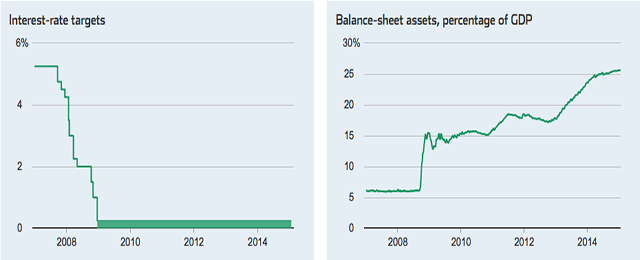

- US interest rates are far below normal.

- The likely period of low US inflation in coming months will not deter the Fed from raising rates.

- This would only change if inflation “is really heading south”.

- The most impressive feature of the US recovery is the continuing decline in unemployment.

Six or seven weeks later, is that interview still pertinent? At that point oil prices stood at close to USD 70 and now they stand below 50. Mostly as a reflection of low global AD (here).The global scenario is changing quickly, and not for the better. So maybe Fischer is not so sure anymore.

PS- When Fischer was Governor of the Bank of Israel he was very “lucky“. Has his “luck” run out?

Be the first to comment on "The Federal Reserve was all set for mid-2015. Is that still true?"