BANKS

“A debt crisis in LatAM is still on the very distant horizon”

For the last four years, Jose Juan Ruiz has been chief economist at the Inter-American Development Bank (IDB), the largest multilateral development aid agency in the region, surpassing the World Bank. Despite the fact LatAm has suffered a massive shock, one of the biggest differences this time round compared to previous slowdowns is that the region has $600 billion of international reserves.

Abengoa Is Saved By Its Creditor Banks

The demise of Abengoa, the Spanish engineering and renewable energy firm, would have been a massive blow for its creditor banks. So the government and the banks have been working on a solution since the company entered pre-insolvency proceedings. The deal agreed this week hands over the majority of Abengoa’s capital to its creditors.

The State Of Italian, German Banks Casts Doubts On Stress Tests Efficiency

The European Banking Authority (EBA) has finished defining the nature of the stress tests, as well as the scenarios the 51 largest European banks will be subject to in 2016. But given the situation of the Italian and German lenders, after the last stress test, there are more and more people who believe there is a certain amount of complicity going on to hide the real situation of many of the banks in both countries.

Can LatAm Banks Perform With Falling Oil Prices?

UBS | China growth concerns and oil price weakness have undermined market sentiment and heightened risk a version in recent weeks. Given EM banks’ credit exposure to commodities/energy sector, estimated at less than 5%, there are also growing concerns over bank sector fundamentals.

Banks Raise Dams, Fend Off Toxic Debt Crisis

Huo Kan and Wu Hongyuran via Caixin | China’s banks are successfully managing 1.92 trillion yuan worth of non-performing loans, but tomorrow could bring a flood of bad debt.

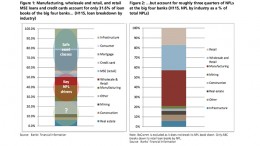

China Private Banks Versus State Sector: Where Do Banks Lend?

UBS | We reviewed the financial statements of 134 banks to understand loan exposure by industry as well as to try to estimate the size of private – sector lending versus state – sector lending.

Now comes the really hard part for Greece

One of the main reasons that Alexis Tsipras wanted to hold elections as soon as possible after agreeing the third bailout in August was that it gave him the best chance of obtaining a fresh mandate before the impact of the latest set of fiscal measures was felt by the average voter.

Greek banks will not need full amount of EU bailout

Athens may need no further than €10 billion to recapitalise its main financial institutions. These are the funds in the Hellenic Financial Stability Fund to cover the sector’s requirements. Looks like in Brussels there is a broader consensus that the figures revealed by the ECB are “encouraging”.

Conditioning Factors For Spain’s Banks In 2016

Last week the Spanish banking sector began its third quarter results presentations, but analysts are going one step further and are already looking for indications ahead of 2016. The outlook is not wholly favourable if we take into account the factors affecting it on the downside.