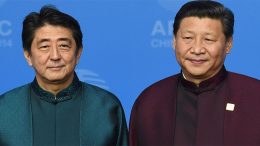

China And Japan’s (Disappearing) Debt Problems

Benjamin Cole | The econosphere is again rumbling about Chinese debt and China banks, evidently forgetting the long serious faces made many times about Chinese debt and China banks in the recent past. But China keeps growing. Japan is another story that defies Western orthodox macroeconomics.