Why ECB’s measures may not fix lending nor inflation

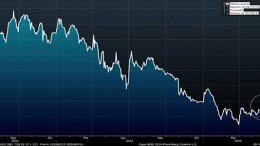

MADRID | The Corner | Despite markets’ euphoric celebration of Mario Draghi’s last words, some remain skeptic about them being the panacea for inflation and the lack of credit in the eurozone. Check the graph above: 5-year swap rates show that inflation expectations have only gone from 1.21/1.24 in May to 1.28/1.24. in June. Nothing to go crazy about, huh?