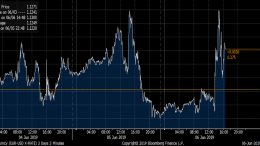

QE returns: the ECB would start as early as 4Q19 with €45bn monthly repurchase

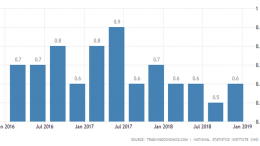

Low growth below the 2% threshold coupled with below-target inflation has led our macros to believe that the ECB is taking extra stimulus for granted. This would mean the return of the centra banks’ asset repurchase program, experts at Morgan Stanley point out..