Nestlé, Procter&Gamble, Unilever… More Fuel For Inflation

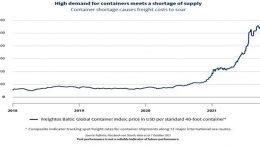

FMCG companies’ quarterly accounts presentations are clearly on the upside, implying that the current bout of higher than usual inflation rates (in recent years) will be with us for longer than expected. For example, Nestlé reported that it is already passing on higher energy, transport and raw material costs to the end customer, resulting in the Swiss company applying an average price increase of 2.1% to its products in Q3’21….