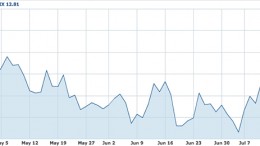

Volatility: Buy some protection before heading to the beach

MADRID | The Corner | “We have been living in an unusually low volatilities -both implied and realized- environment,” JP Morgan’s Fernando Cavia argues. But the last two weeks analysts are seeing a change of trend: protection is gaining fans among European institutional investors who see some threat to equities’ potential.