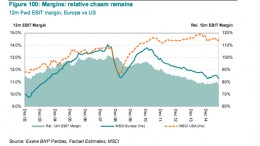

US-Europe Desynchronised Cycles

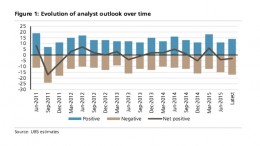

The major economies are now characterised by desynchronised economic cycles, with divergent policy regimes. This complicates the equity investment decision. Europe may be a relative winner, but too much of the globe is seeing financial conditions tighten, against lacklustre growth, to be optimistic on directional trends. We see downside risk through the opening months of 2016. The European economy is moving in the right direction and further ECB action promises…